Vanguard funds now available in PSD 457(b)!

This post is for educational purposes only! This is not investing advice!

Vanguard index funds are available in PSD’s 457(b) retirement plan! Why is this a big deal? FEES! Vanguard index funds have some of the lowest fees in the industry. Over your investing lifetime, you might save hundreds of thousands of dollars by using a low fee product.

Who should consider using the PSD 457(b)?

After seven years, PSD classified employees automatically receive a 457(b). Your money goes into the default fund, which is probably not the most desirable option. Besides classified employees, ANY employee who plans to retire from PSD early, might consider the 457(b) because you can access the money before 59.5 without penalty! Since I plan to retire early, I am maxing out my 457(b) to give my family another source of income before I reach 59.5. If you are trying to decide between the 401(k) and 457(b), the 401(k) has lower fees but the 457(b) can be accessed as soon as you retire from PSD. If you'll retire early, and need the money at retirement, use the 457. If not, use the 401(k) due to lower fees. I max out both my 457(b) and 401(k) each year.

What fund(s) should you choose?

I’ll explain three strategies below. To enroll in or change your contribution amount in the 457 plan, you must use the online enrollment system at www.gwrs.com or call 877-816-0548 (option 3). The change will be effective the following month.

Strategy 1:

If you’ve read JL Collins’ The Simple Path to Wealth you know that he says to go 100% Vanguard Total Stock Market. This is a very aggressive approach. If you choose this option, plan on lots of volatility. However, in the long run, you’ll probably experience high returns. If you are very young, and have many years until retirement, this might be okay. As you approach retirement, you'll want to begin adding Vanguard total bonds (read the book for details).

Strategy 2:

Build your own custom Vanguard Life Strategy Fund. There are four funds, that you can mimic, based on your risk tolerance. You can set your selection to automatically re-balance annually, bi-annually, or quarterly (on the Empower website).

Strategy 3:

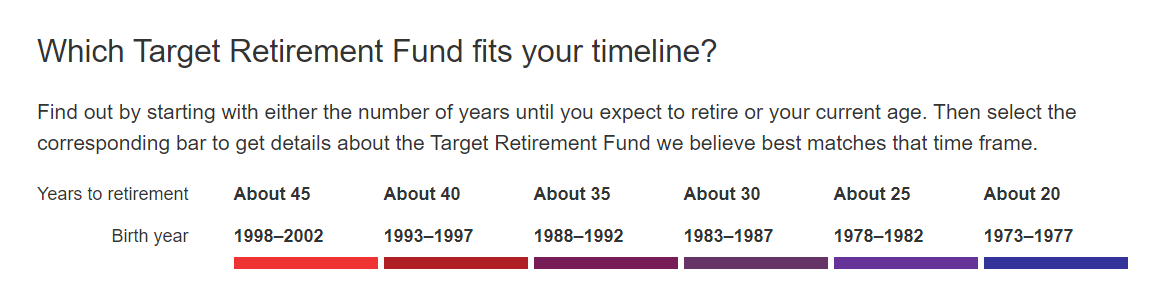

Build your own custom Vanguard Target Date Fund. There are nine of these based on your approximate retirement year. Because you will be building this manually, you'll need to revisit your selections each year and make adjustments based on Vanguard's website (below).

Nothing presented is to be construed as investment advice. Investment advice can be secured from a vetted Certified Financial Planner (CFP®).When working with a CFP®, it is recommended that s/he sign a Fiduciary Pledge. More information, including questions to ask a planner and a downloadable Fiduciary Pledge, can be found here: https://403bwise.org/education/professional

Comments

Post a Comment